By A Mystery Man Writer

Being self-employed lets you deduct business travel expenses. Follow this self-employed tax guide to learn how to claim travel expense deductions.

Travel for business? Here's how to deduct your travel expenses and save money

How to Deduct Business Travel Expenses: Do's, Don'ts, Examples

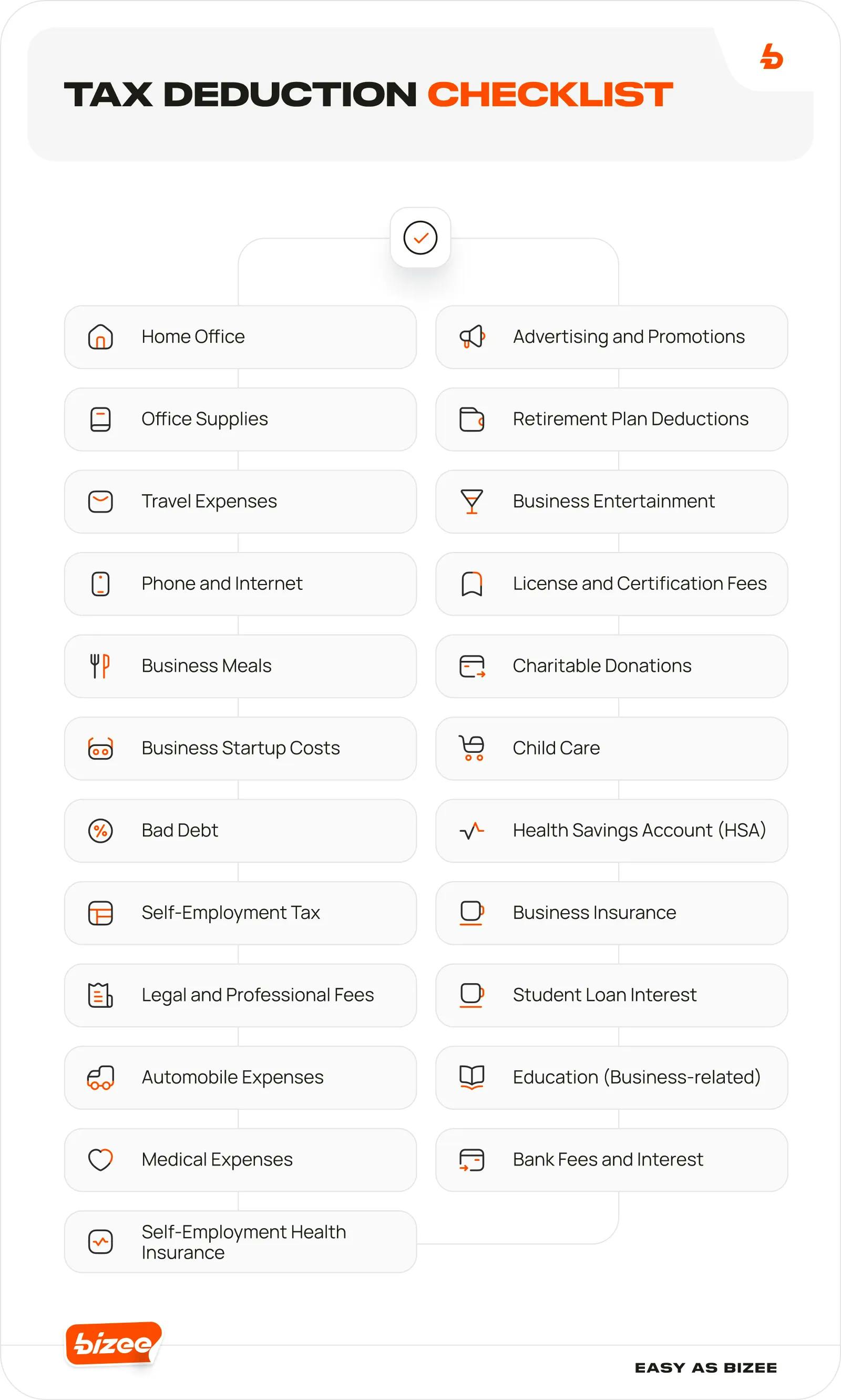

2023 Tax Deduction Cheat Sheet and Loopholes

Home Office Deductions for Self-Employed and Employed Taxpayers

17 common self-employed tax deductions

16 Tax Deductions and Benefits for the Self-Employed

Business Expense Categories Cheat Sheet: Top 35 Tax-Deductible Categories

Travel Expenses - FasterCapital

Tax Deductions for the Self-Employed: a Guide

Expenses you can claim if you're self-employed in Ireland

Publication 463 (2023), Travel, Gift, and Car Expenses

Small Business Deductions Canada — Fix My Books

Employment Expenses Line 22900

IRS Rules for Recording Business Expenses: Travel, Transportation, Meals and Entertainment