Recently, Pakistan’s Appellate Tribunal Inland Revenue (ATIR second tier appeal forum) has allowed an appeal against the tax authority’s order for recovery of withholding tax

Pakistan

Preferential Trade Agreement Policies for Development (2) by ICTSD

China–Pakistan Economic Corridor - Wikipedia

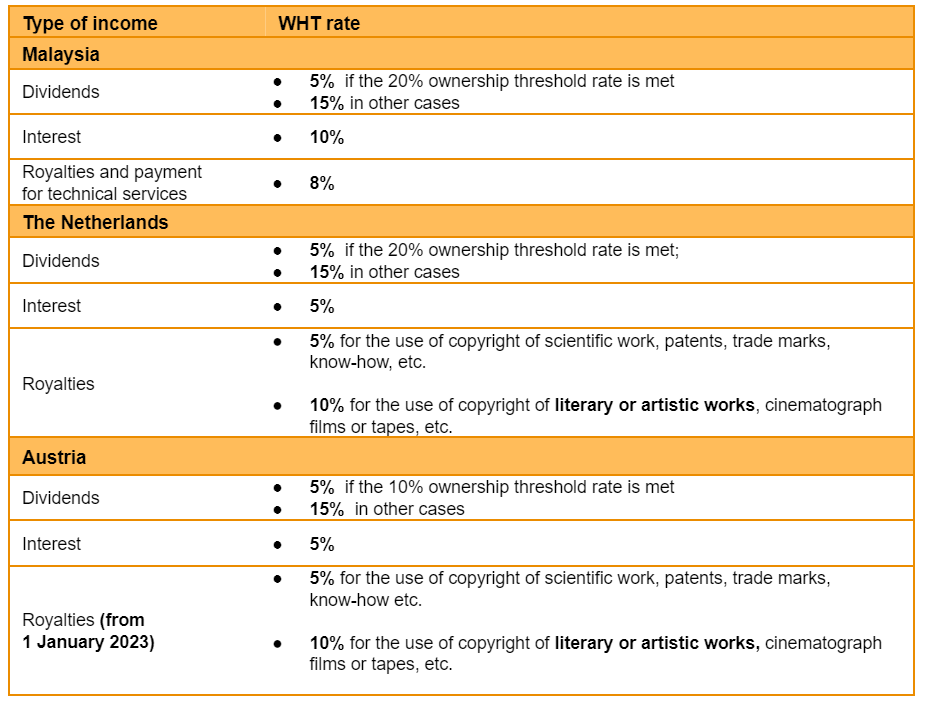

2022 Double Tax Treaty Update

Chapter 2. Modernizing the Tax Policy Regime in: Modernizing China

Document

tm2214644d1_ex99-1img001.jpg

Chapter 2. Modernizing the Tax Policy Regime in: Modernizing China

Adv Tax Note, PDF, Taxes

Double Taxation Agreements for China Investment - China Briefing News

ITP Newsletter